Australia & International Holdings Limited

Australia & International Holdings Limited

Burrell's own Listed Investment Company

Australia & International Holdings Limited (AIH) is a listed public company trading on the National Stock Exchange of Australia (NSX). Its primary objective is to provide investors with dividend returns as well as capital growth.

AIH originated in 1985 when a group of investors formed an investment club. The investment portfolio was initially held by a private company, which in 1998 became the public company, AIH, with an NSX code of AID.

As at 30 June 2023, AIH had net assets of approximately $5.57M held in a strategically balanced and well-diversified set of portfolios. The majority of shareholder funds are invested over a medium to long-term period in both Australian and international companies, as well as managed funds.

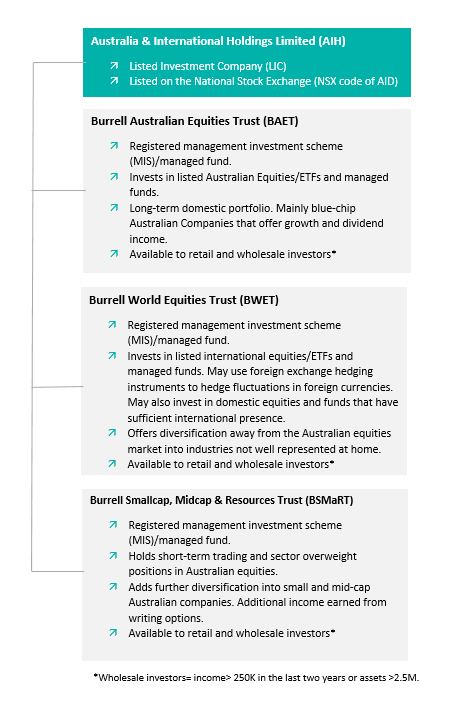

As shown in Figure 1, most AIH investments are facilitated through its managed investment schemes: Burrell Australian Equities Trust (BAET), Burrell World Equities Trust (BWET), and the Burrell Smallcap, Midcap and Resources Trust (BSMaRT).

Figure 1. AIH structure.

As at 30 June 2024, approximately 92.3% of AIH’s investment portfolio was invested in BAET (56.3%), BWET (25.0%) and BSMaRT (11.00%). This was achieved through the following ownership structure: AIH owned 38.8% of the units on issue in BAET, 22.3% of the units on issue on BWET, and 24.2% of the units on issue in BSMaRT.

Through the three portfolios, AIH invested in the following industry sectors, countries and companies/investments:

| AIH investment industry sectors | 30-Jun-24 % |

Energy | 5.3 |

Materials | 14.6 |

Industrials | 7.0 |

Consumer discretionary | 5.8 |

Consumer staples | 4.8 |

Financials | 38.7 |

Managed funds and LICS | 5.3 |

Health Care | 10.8 |

Information technology | 4.3 |

| Telecommunication Services & Utilities | 2.9 |

Real estate investment trusts | 0. |

Region allocation | 30-June-24 % |

Australia & New Zealand | 76.4 |

Americas | 8.4 |

United Kingdom | 0.3 |

Europe excl. United Kingdom | 4.4 |

Asia Pacific excl. Australia | 1.3 |

Global | 9.2 |

Top 20 underlying investments | 30 Jun 23 (% of underlying portfolio) |

COMMONWEALTH BANK OF AUSTRALIA FPO | 7.61% |

WESTPAC BANKING CORPORATION FPO | 3.79% |

| ANZ Group Holdings Limited FPO | 3.74% |

Incometric Fund - Class B | 3.55% |

CSL LIMITED FPO | 3.19% |

NEWMONT CORPORATION CDI 1:1 FOREIGN EXEMPT NYSE | 2.83% |

MACQUARIE GROUP LIMITED FPO | 2.71% |

| SANTOS LIMITED FPO | 2.57% |

WOODSIDE ENERGY GROUP LTD FPO | 2.52% |

NATIONAL AUSTRALIA BANK LIMITED FPO | 2.52% |

SOUTH32 LIMITED FPO | 2.41% |

AMCOR PLC CDI 1:1 FOREIGN EXEMPT NYSE | 2.27% |

BHP GROUP LIMITED FPO | 2.26% |

CHALLENGER LIMITED FPO | 2.14% |

RESMED INC CDI 10:1 FOREIGN EXEMPT NYSE | 1.93% |

SUNCORP GROUP LIMITED FPO | 1.73% |

SONIC HEALTHCARE LIMITED FPO | 1.57% |

ANZ USD | 1.36% |

RAMSAY HEALTH CARE LIMITED FPO | 1.35% |

APPLE ORD | 1.26% |

Shareholder information

Net Asset Value

The net asset value per fully paid share as at 10th April was $3.15.

AGM date

The next AGM will be held on 20th November 2024 at 12:00pm.

Annual Reports

Dividend history

AIH has a strong history of paying dividends and its dividend yield compares very well.

Year | NAV (¢) | Interim ordinary dividends per share (¢) | Interim dividend franking (%) | Final dividends per share (¢) | Final dividend franking (%) | Total dividends per share (¢) | Dividend yield (%) |

| 2023 | 316 | 6.0 | 100 | 6.0 | 100 | 12.0 | 3.80 |

| 2022 | 304.00 | 5.0 | 100 | 5.5 | 100 | 10.5 | 3.45 |

2021 | 318.00 | 4.5 | 100 | 4.5 | 80 | 9.0 | 2.83 |

2020 | 285.00 | 6.0 | 100 | 4.5 | 100 | 10.5 | 3.85 |

2019 | 313.00 | 6.0 | 100 | 6.5 | 100 | 12.5 | 3.96 |

2018 | 305.00 | 6.0 | 70 | 6.0 | 65 | 12.0 | 3.93 |

2017 | 301.00 | 6.0 | 70 | 6.0 | 75 | 12.0 | 3.99 |

2016 | 291.00 | 6.0 | 75 | 6.0 | 75 | 12.0 | 4.26 |

Dividend Reinvestment Plan

AIH operates a dividend reinvestment plan that enables shareholders to receive all or part of their dividends in shares. For full details of the plan and application form, please follow the links below:

Get started

Contact us for an obligation-free conversation.

Call 1300 4 BURRELL or read the most recent AIH newsletter for the latest news and investment results.

- Home

- Our Services

- About Us

- Disclaimers & Disclosures

- Burrell Online Managed Portfolios

- Burrell Online

- My Burrell Login

- My Portfolio