Chris Burrell's Market View Blog - November

Chris Burrell's Market View Blog - November

22/11/2023

November 2023 Insights

I. OVERSEAS OBSERVATIONS

Having recently returned from long service leave (deferred from 2020), the following observations may be of interest:

AUSTRALIA RECEIVES TIMELY & RELIABLE DATA

The reporting of overseas GDP, market and interviews with the key executives from the central banks, companies and government together with instant television, internet and broadcast services means that Australia is receiving timely and reliable data on market movements overseas. Gone are the days of waiting for delayed communications from London, New York and other major markets. Moreover, Australia now features regularly in those reports, including such services as Bloomberg.

REMEMBER A COUNTRY’S GDP -> STOCK MARKET CYCLE

While the press often give the impression that Australia follows London and New York without blinking, in fact, the major determinant of a country's stock market cycle is its gross domestic product (GDP).Different economies cycle differently. It is becoming increasingly clear that the US economy is stronger than that of Australia and in turn the laggard is the European Union.

GEOPOLITICAL NOISE ABOUNDS

Seldom has there been such a range of negative geopolitical forces. In 2023, it has been useful to cut through this noise and indeed the market has largely ignored all but the two factors in the following dot point. However, there is a risk that the extreme issues coming from Russia, China, and Israel/Gaza are now of such an amplitude that there will be a more extreme X factor which may impact on markets.

- First major concern as Putin always said, if he is cornered, he will strike out and he certainly looks cornered.

- Second major concern is the Arab countries coming together in response to the treatment of the Palestinian people in Gaza. Iran has supplied weapons to multiple terrorism groups and acted as a disrupter.

There is a heightened risk that these geopolitical forces will escalate to a new level. Let’s hope not, but history is replete with Arab uprisings.

INFLATION, INTEREST RATES KEY FOCUS

So far, the markets have ignored the geopolitical noise in the preceding paragraph with the exception of inflation and interest rates. The most recent data from the USA was taken positively by the markets in support of a soft landing and no major recession in 2024.

HEALTHCARE, TRAVEL + VE

In terms of sectors observed to be running independently, healthcare continues to be driven by the baby boomer demographic and the increased ability of modern medical care and medicines to create successful interventions if medical issues are detected early enough.

Travel has also been positive, with COVID largely overcome presently by vaccines and immunity.

RETAIL – VE SINCE APRIL/MAY 2023

Globally, the rapid rise in interest rates around the world in the 12 months to April/May 2023 is having an effect on retail sales. This parallels the position in Australia with electronics and home furnishings down around 15%, jewellery 20%, whilst fuel & convenience and grocery are showing some positive movement, albeit mostly as a result of inflation and with little real increase in volumes. Apparel had held up, but Country Road and Estee Lauder announced double digit declines (FYTD) financial year to date.

ASSET VALUATIONS ADJUSTING TO NORMALIZING INTEREST RATES

Increases in interest rates mean that the value of future cash flows is reduced, as the net present value of those discounted cash flows at higher weighted average costs of capital results in lower numbers, all else being equal.

Of course all else isn't equal. For example in the property area where Industrial Property rents are rising at 20%, Industrial Property valuations are holding better than those in other sectors eg. Office.

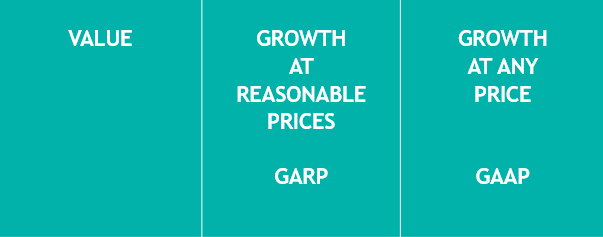

Growth at any price companies (GAAP) include new technology, unprofitable small-mid cap companies and speculative miners. GAAP stocks are susceptible to higher costs of capital, particularly where revenues disappoint market expectations. This has led to considerable volatility in GAAP stocks.

II. MULTIPLE DRIVERS 2023

As we navigate the final quarter of calendar 2023, inflation and higher interest rates remain a key focus. Also relevant are the following multiple factors that will drive 2023:

- Inflation -> Higher interest rates

- Students & migration flood

- Tight rental & housing market

- Supply chain pressure easing

- COVID beaten by vaccines

- Government leadership falters

- Labour and skill shortages

- Savings buffers running down

These factors are not uniform across global economies. In the UK for example, higher interest rates are having the expected effect of leading to lower property prices. This is not so in Australia, where the influx of students and migration together with the failures of many builders as a result of being caught with fixed price contracts in an inflationary environment which the Reserve Bank of Australia said would not occur. These tight rental and housing markets are more of a feature in Australia than in other overseas countries and do not bode well for Australia bringing inflation under control. Similarly, labour and skill shortages in Australia have continued to bolster inflation, particularly in the services area. For example, in hospitality, hotels and motels have increased room rates, even though normally this would not have occurred until occupancy was much higher. The lack of labour means that hotel and motel owners have resolved to charge higher prices because they know that their competitors cannot obtain skilled hospitality workers either.

So, again, this is being reflected in inflation.

The last factor above being savings buffers running down is of concern as those buffers were built up during COVID with the various government stimulus programs. Higher interest rates on mortgages together with inflation mean that we're seeing some impact on spending. eg. the retail spending numbers noted previously in this blog.

III. VALUE VERSUS GROWTH

There are some good value stocks, including banks and industrials, at attractive valuation multiples and with good yields, both in Australia and overseas. Generally speaking the yields in Australia are superior due to franking. Overseas countries with the classical taxing system see lower dividends, higher executive salaries and a greater number of mergers and acquisitions, which the evidence suggests may not be value accretive.

Growth at reasonable prices (GARP) stocks were in a number of instances, bid up by the GAAP category. The good news is that such stocks have reverted to more compelling levels in a number of cases. It is pleasing to be able to buy a number of these stocks after watching them at high levels for the last two-three years.

IV. TOWARDS 2024

The slowing global economies may result in reduced earnings expectations. While some companies reported well recently, reduced earnings expectations mean lower growth and in turn, reduced valuations. The Burrell Investment and Research Committee sees the need for care holding 5-10% in cash and investment decisions based on considered independent research and insights, rather than momentum and sentiment.

Please contact your Burrell Advisor to discuss our current list of GARP stocks which may complement your portfolio.

Happy investing,

Chris Burrell

Managing Director

Disclaimer & Disclosure: Burrell Stockbroking Pty Ltd and its associate’s state that they and/or their families or companies or trusts may have an interest in the securities mentioned in this report and do receive commissions or fees from the sale or purchase of securities mentioned therein. Burrell Stockbroking and its associates also state that the comments are intended to provide information to our clients exclusively and reflects our view on the securities concerned and does not take account of the appropriateness of the recommendation for any particular client who should obtain specific professional advice from his or her Burrell Stockbroking Pty Ltd advisor on the suitability of the recommendation. Whilst we believe that the statements herein are based on accurate and reliable information, no warranty is given to its accuracy and completeness and Burrell Stockbroking Pty Ltd, its Directors and employees do not accept any liability for any loss arising as a result of a person acting thereon.

This document contains general securities advice only. In accordance with Section 949A of the Corporations Act, in preparing this document, Burrell Stockbroking did not take into account the investment objectives, financial situation and particular needs ('relevant personal circumstances') of any particular person. Accordingly, before acting on any advice contained in this document you should assess whether the advice is appropriate in the light of your own relevant personal circumstances or contact your Burrell Stockbroking advisor. If the advice relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure Statement relating to the product and consider the Statement before making any decision about whether to acquire the product.

- Home

- Our Services

- About Us

- Disclaimers & Disclosures

- Burrell Online Managed Portfolios

- Burrell Online

- My Burrell Login

- My Portfolio